Cryptocurrency live charts have transformed the way investors and traders make decisions. In an ever-volatile cryptocurrency market, where prices shift every second, a live chart serves as a real-time window into the market’s heartbeat. By tracking price movements, trading volumes, and market trends, live charts provide vital insights that enable users to make informed, data-driven trading decisions.

In this guide, we’ll delve into how to read a cryptocurrency live chart, understand its critical components, and use it as a powerful analytical tool. From beginners to experienced traders, understanding cryptocurrency live charts can significantly improve trading accuracy and profitability.

The Basics: What is a Cryptocurrency Live Chart

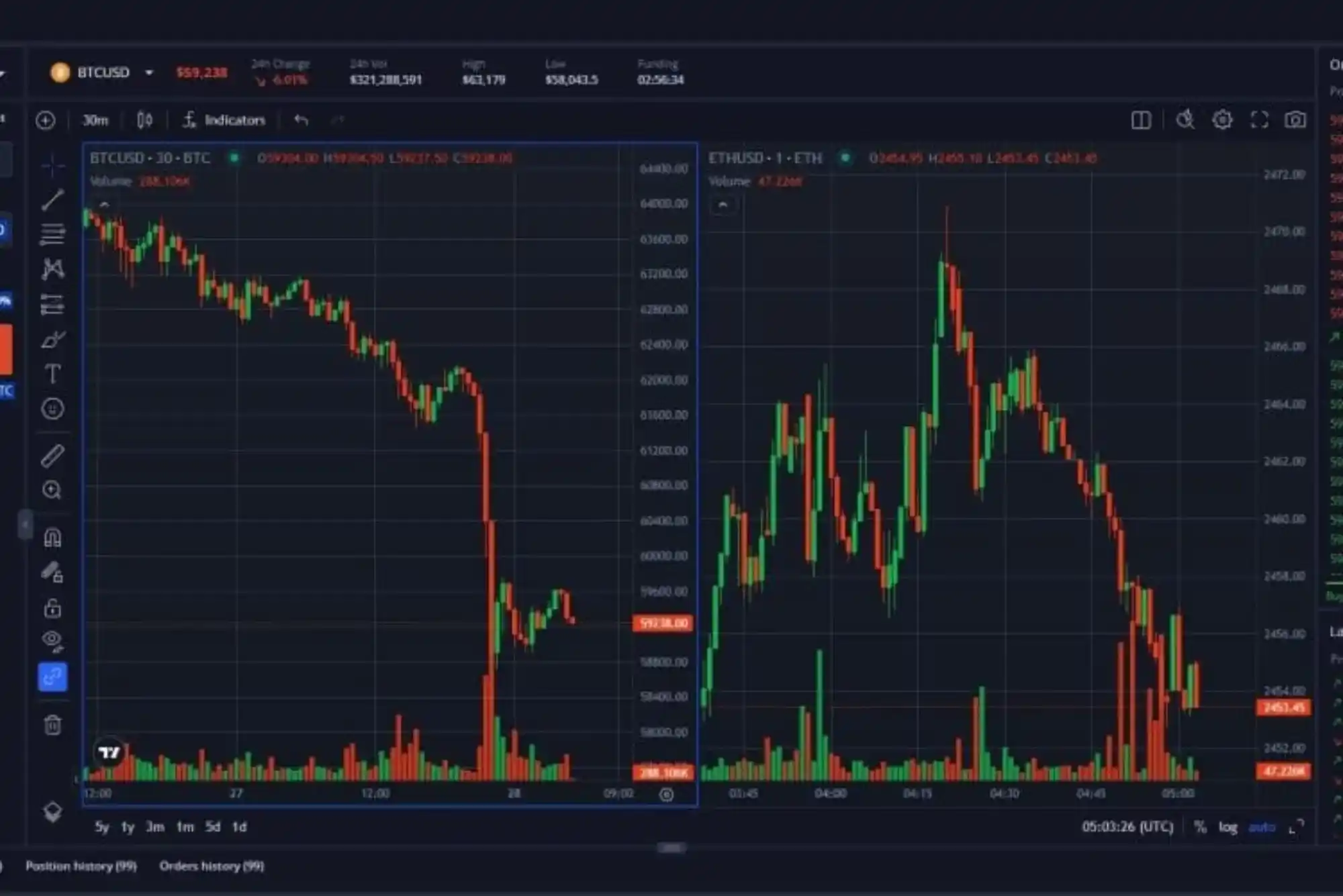

A cryptocurrency live chart is a visual representation of real-time market data, displaying a digital asset’s price changes, market trends, and trading volumes. Unlike static charts, which only show data at a single point in time, live charts update continuously, giving traders instant insight into what is happening in the market.

For instance, when Bitcoin’s price fluctuates, a live chart captures this movement immediately, reflecting it visually through price candlesticks or line graphs. This real-time data is invaluable for day traders who need to make split-second decisions.

Core Components of a Cryptocurrency Live Chart

Cryptocurrency live charts can appear overwhelming at first, but breaking down their key components can simplify understanding:

Price Candlesticks

Price candlesticks display the opening, closing, high, and low prices of an asset within a given time period. These candlesticks form patterns that help traders identify trends and potential market reversals. The candlesticks’ colors and shapes indicate whether a price has increased or decreased within the time frame, with green or white indicating gains and red or black indicating losses.

For instance, a series of green candlesticks could signal a bullish trend, whereas consecutive red candlesticks could suggest a bearish trend.

Volume Indicators

Volume indicators reflect the number of units traded over a given time frame. This component is crucial for understanding market sentiment; high trading volumes during price increases suggest strong buying pressure, while high volumes during price drops may indicate strong selling pressure.

Moving Averages

Moving averages smooth out price data by calculating the average price over a set period, helping traders identify trends by filtering out market noise. Common moving averages include the 50-day and 200-day averages. These lines on the chart act as support or resistance, indicating possible reversal points.

From beginners to experienced traders, understanding cryptocurrency live charts can significantly improve trading accuracy and profitability.

Support and Resistance Lines

Support lines mark price levels where an asset tends to stop falling and start rising, while resistance lines denote levels where an asset may stop rising and begin to fall. Identifying these lines can help traders make more strategic entry and exit points.

Using Technical Indicators on Cryptocurrency Live Charts

Cryptocurrency live charts come with numerous indicators that traders can use to gain deeper insights. Let’s explore some popular ones:

Relative Strength Index

The RSI indicator measures the speed and change of price movements, helping to assess if an asset is overbought or oversold. It ranges from 0 to 100, where readings above 70 suggest overbought conditions, and below 30 indicate oversold conditions.

Moving Average Convergence Divergence

The MACD indicator tracks momentum by calculating the difference between two moving averages, typically the 12-day and 26-day. When the MACD crosses above the signal line, it suggests a potential buy opportunity; conversely, a cross below the signal line may indicate a selling opportunity.

Bollinger Bands

Bollinger Bands measure market volatility. They consist of a moving average with an upper and lower band representing standard deviations. When prices hit the upper band, the asset may be overbought, and hitting the lower band may indicate oversold conditions.

Cryptocurrency Live Chart Platforms:

Several platforms offer comprehensive cryptocurrency live chart tools, each with unique features:

| Platform | Key Features | Pricing |

|---|---|---|

| TradingView | Advanced customizable charts, extensive indicators, and alerts | Free & Paid |

| CoinMarketCap | Real-time charts with easy access to historical data and volume data | Free |

| Binance | Integrates charting with trading features, includes multiple indicators | Free for users |

These platforms provide a range of analytical tools, from simple trend lines to complex indicators, enabling users to tailor charts to their trading needs.

Common Mistakes When Using Cryptocurrency Live Charts

Using live charts effectively requires understanding common pitfalls. Some traders rely on a single indicator, which can lead to misinterpretations. Instead, combining multiple indicators gives a fuller picture of market conditions. Another mistake is not setting appropriate time frames, as short timeframes may produce “noise” that doesn’t accurately reflect market trends.

The Strategic Advantage of Cryptocurrency Live Charts in Volatile Markets

Cryptocurrencies are known for their price volatility, making live charts invaluable tools for market analysis. Traders who use live charts effectively can anticipate price shifts and respond quickly to capitalize on profitable moments. By setting up price alerts, using volume analysis, and tracking candlestick patterns, traders gain a strategic advantage in fast-paced markets.

Using Cryptocurrency Live Charts for Smarter Trading

Understanding cryptocurrency live charts can transform the way you trade by giving you real-time insights into the market’s current and future direction. From candlestick analysis to technical indicators, live charts offer the tools needed for more informed decision-making, enabling traders to navigate the market with greater confidence.

With live charts at your disposal, you’ll be better equipped to interpret price action, identify trading signals, and maximize your potential for profitable trades. Dive into the world of cryptocurrency live charts, and let data drive your trading strategy.